They’re playing to minimize payouts. You’d better play to win.”

Most policyholders think filing an insurance claim is simple: You report the damage, they send someone out, and a fair check follows shortly after.

If only it were that easy.

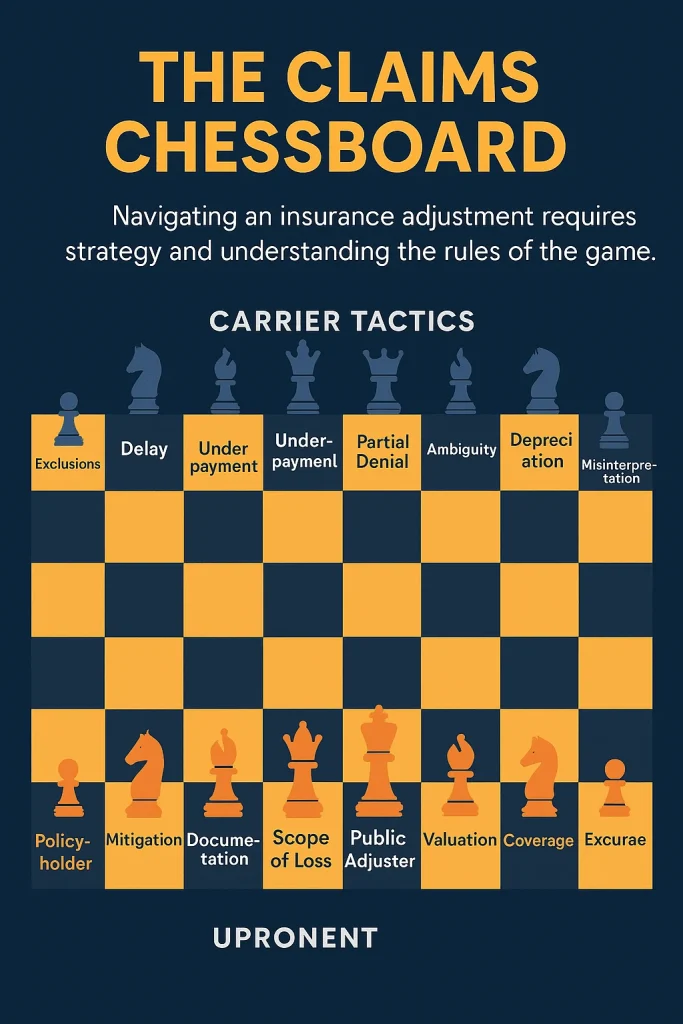

The truth? Insurance is a high-stakes, rules-heavy game—and most people are playing checkers on a chessboard built by the carrier.

At Only Plans Claims & Consulting, we’ve seen this firsthand. From subtle denials buried in confusing language to delay tactics disguised as “procedural steps,” the claims process is designed to serve one purpose: protect the carrier’s bottom line.

Here’s why strategy matters, and how the right advocate can turn the game in your favor.

🎯 The Board Is Set Before You Even File

The policy you bought? It’s a contract—written by the insurance company, not you. That contract is filled with:

- Exclusions you didn’t see

- Time-sensitive requirements

- Language that looks open-ended but is actually restrictive

The minute a loss happens, the clock starts ticking. Every email, every inspection, every form—it all becomes part of the game. And unlike checkers, where every piece moves the same, this board has layers.

🧩 Claims Are Tactical—Not Just Technical

A roofing contractor may know the damage. A mitigation company may know the moisture levels. But who knows how to argue for coverage based on policy interpretation, documented evidence, and case law?

That’s where strategy wins.

The carrier may say:

- “That’s wear and tear.”

- “This isn’t a covered peril.”

- “You didn’t mitigate fast enough.”

- “We only owe for spot repairs.”

But with a skilled advocate, you can counter with:

- Building code mandates

- Manufacturer installation specs

- Thermal imaging proof

- Policy language with supporting case precedent

You’re not arguing feelings—you’re moving pieces with purpose.

👣 Every Step Must Be Calculated

- Filing too soon? They may say it wasn’t properly documented.

- Filing too late? They may say it’s excluded.

- Not having your own estimate? They’ll lowball you and call it a day.

- Accepting partial payment? They may close the file without warning.

This is why OPCC treats every claim like a chess match. Not because we’re dramatic, but because you only get one shot to get it right.

🧠 Why Advocacy Isn’t Optional—It’s Strategic

An experienced public adjuster doesn’t just show up to represent you—they show up with:

- An understanding of carrier behavior.

- Knowledge of how claims are built, denied, reopened, and paid.

- A playbook built on real outcomes, not guesswork.

We know when to press, when to pause, and when to bring in reinforcement. We speak carrier, contractor, code compliance, and coverage fluently. And we know when they’re bluffing.

💥 Closing Thought: Play Smart, Not Fast

Insurance companies rely on confusion, fatigue, and delay. But with the right guidance, the board changes.

If your claim is denied, delayed, or underpaid—remember:

This isn’t checkers. It’s chess.

We know how to play. And we play to win.