A lovingly sarcastic look at the myths, misfires, and madness that plague the insurance claim world—brought to you by people who actually read the policy.

Welcome to the claims industry, where logic goes to die, and common sense is an optional endorsement.

We’re not here to call people out (okay maybe a little), but after reviewing thousands of claims, we’ve collected a greatest hits list of the dumbest, most misguided, or just flat-out wrong things we’ve heard adjusters, contractors, and sometimes even policyholders say with their whole chest. Let’s myth-bust a few, shall we?

❌ “Matching isn’t covered.”

Oh really? Because unless your policy explicitly excludes matching, your carrier owes to make the property whole—not patch it like a quilt from the discount bin at Michaels. Also: check state statutes. Some states require matching by law. So maybe let’s not wing it on legally binding contracts.

❌ “If it wasn’t damaged by the hail, we don’t owe for it.”

Cool. So you’re saying you’re gonna pay to fix half a roof slope, and leave the other half with 12-year old shingles, creating a mismatch and voiding the warranty? That’s not claim handling. That’s sabotage with paperwork.

❌ “You didn’t mitigate fast enough, so we’re denying coverage.”

Ah yes. Because when your kitchen ceiling caves in from a pipe burst at 3:12 AM, what you should’ve done was grab a mop and tarp and file a notarized affidavit of heroic effort within 7 minutes. Got it.

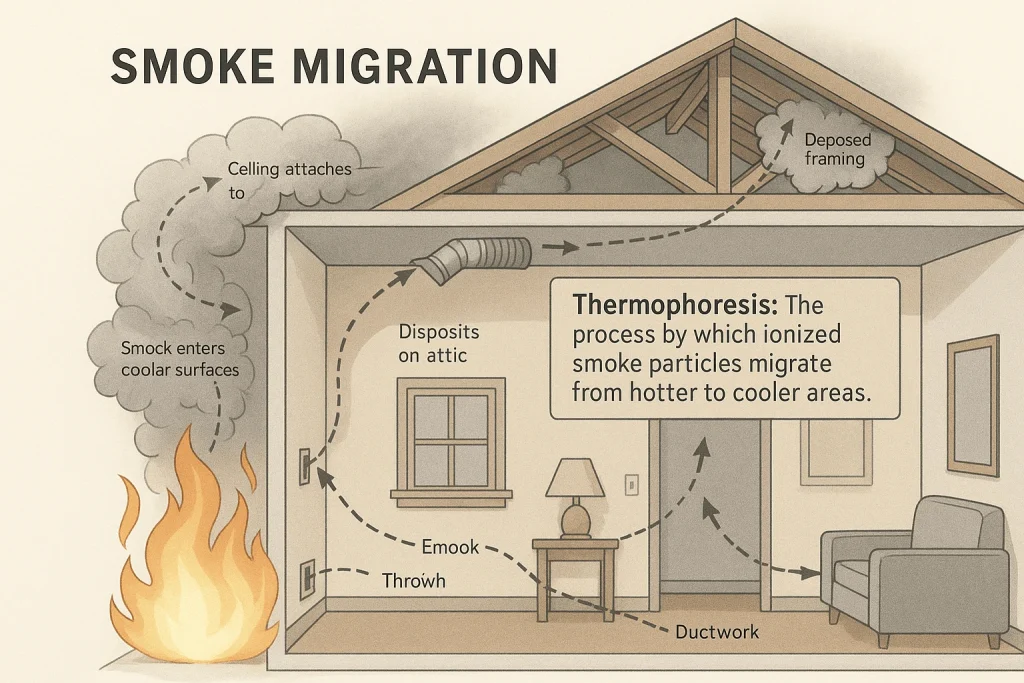

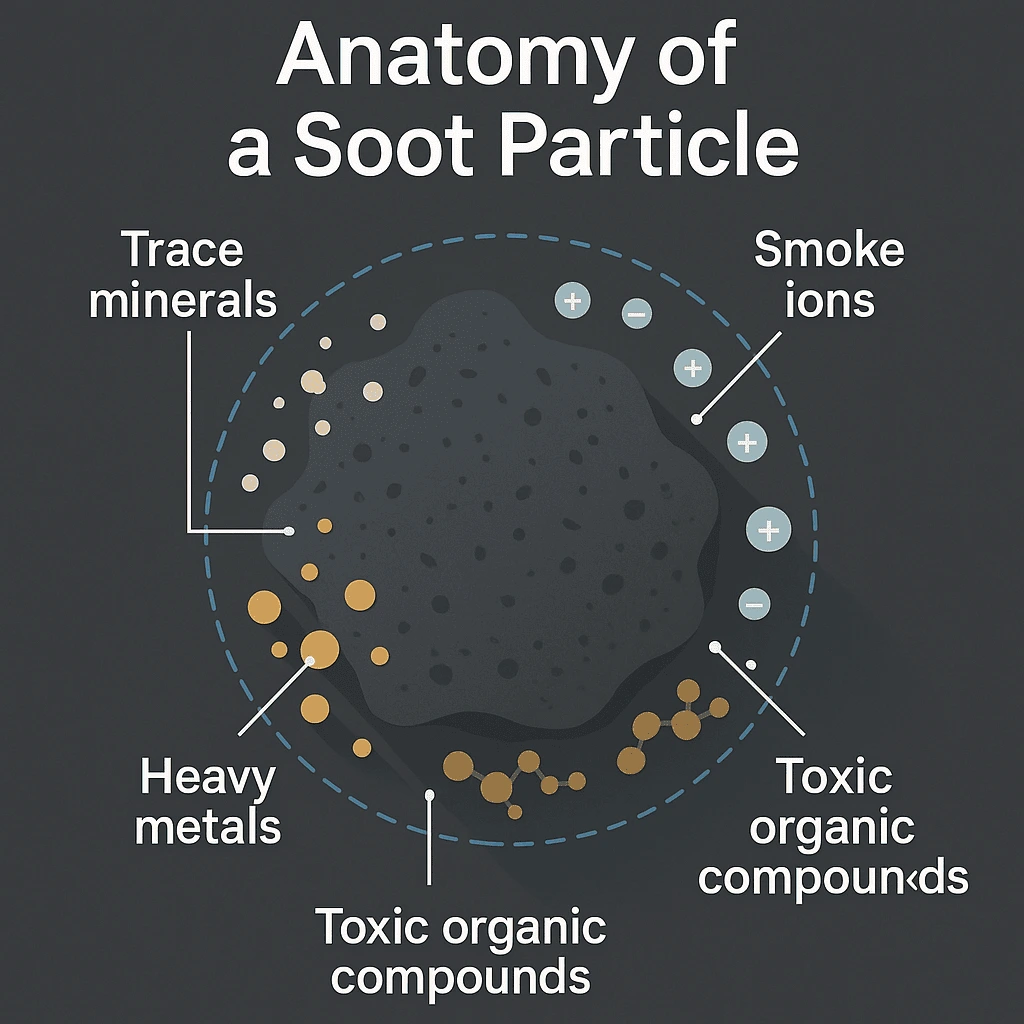

❌ “Smoke odor is cosmetic.”

Tell that to the lungs, the headaches, the HVAC system that’s recycling chemical particulates, and the insulation that smells like a burned Barbie dreamhouse. You don’t Febreze your way out of thermophoresis, friend.

❌ “We don’t owe to reinstall ‘abandoned’ materials.”

First off—what even is an “abandoned” shingle layer? If it’s nailed to the home, it’s not abandoned. It’s installed. And if it needs to be removed and replaced to restore pre-loss condition, you owe for it. Full stop.

❌ “Contractors can’t talk to the insurance company.”

They sure do when it’s convenient. Suddenly the painter is providing moisture readings and the demo crew is interpreting policy language like they’re on Law & Order: Special Claims Unit. Want less contractor confusion? Loop in a PA.

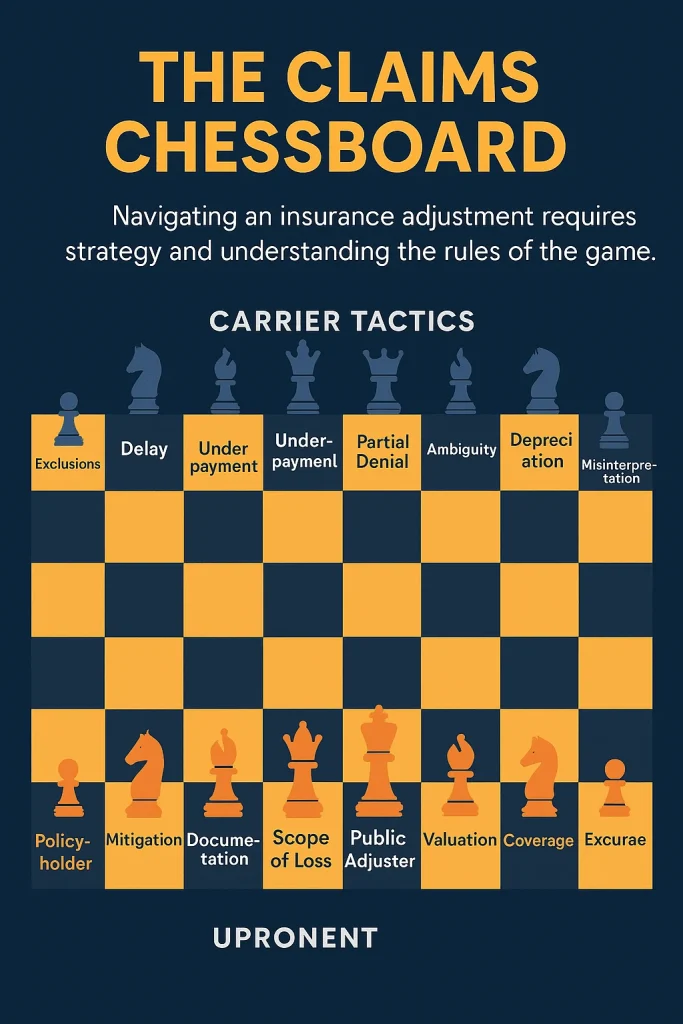

🧠 The Problem with Misinformation in Claims

The truth is, most of this nonsense doesn’t come from malice—it comes from a system that thrives on confusion, overwhelm, and delay. The less you know, the less they owe. That’s the math.

That’s why OPCC exists. We don’t scream. We don’t threaten. We don’t email in all caps. We just know what the policy says, what the law allows, and what the insured is entitled to. And if that makes us the smartasses in the room—well, at least we’re smart.

Got Something Dumb You Heard on a Claim?

Send it to us. Maybe we’ll feature it in the next edition of “Did They Really Just Say That?”(And yes, we’ll keep you anonymous… unless it’s too good.)